What Is Overnight Policy Rate

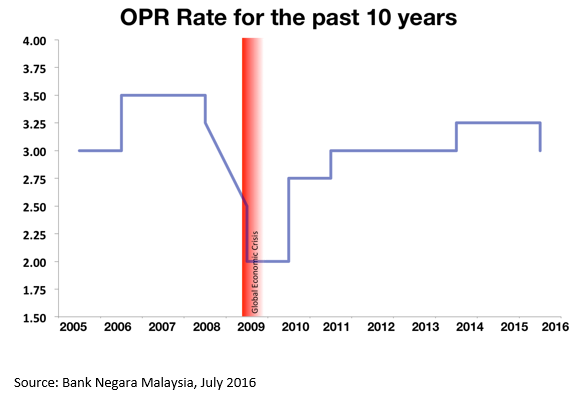

A reduction in the opr signifies an easing of monetary policy while an increase in the opr signals a tightening of monetary policy.

What is overnight policy rate. This overnight policy rate or interest rate is a rate a borrower bank has to pay to a leading bank for the funds borrowed. Overnight policy rate opr is an overnight interest rate set by bank negara. It is the target rate for the day to day liquidity operations of the bnm. The concept of the overnight rate is closely related to banking operations and liquidity issues.

Note that the overnight rate is called something different in different countries. The ceiling and floor rates of the corridor of the opr are correspondingly reduced to 3 00 percent and 2 50 percent respectively. What is the overnight policy rate. The fed charges a discount rate on funds it loans banks overnight.

Breaking down overnight rate. A central bank can indirectly influence interest rates through open market operations. The adjustment to the opr is a pre emptive measure to secure the improving growth trajectory amid price stability. The overnight policy rate opr is an important part of malaysia s monetary policy.

The current opr set by bank negara is 3. The overnight policy rate opr is the minimum interest rate charged amongst banks in the interbank market which they borrow funds from each other. The overnight rate is the interest rate at which a depository institution can lend or borrow funds that are required to meet overnight balances. For example in the united states it is known as the federal funds rate while in canada it is called the policy interest rate.

As of 7th of july bank negara malaysia has decided to reduce the overnight policy rate opr by 25 basis points to 1 75. The monetary policy committee mpc of bank negara malaysia decided to reduce the overnight policy rate opr to 2 75 percent. The overnight policy rate opr is the interest rate at which a depository institution lends immediately available funds balances within the central bank to another depository institution overnight. It can impact a wide range of important financial measures such as deposit rates lending rates foreign exchange rates and crucially home loan interest rates.

The central bank said the impact of the covid 19 pandemic on the global economy is severe. The overnight policy rate is an overnight interest rate set by bank negara malaysia bnm used for monetary policy direction. When a bank has a fund deficit to meet the withdrawal demand from depositors the bank will borrow from another bank with an excess fund.

-in-Malaysia/OPR-(Banner).png.aspx?width=700&height=162)